Since the beginning of the year, the dollar exchange rate of Bitcoin is up 27%. The original and leading cryptocurrency, it still accounts for over 41% of the total cryptocurrency market’s value, has recovered alongside the tradition assets classes of stocks and bonds this year.

The strong start to the year, which has seen the Bitcoin price top $21,000 again from a recent low of $15,757.2 set on November 9th 2022, has raised hopes among bulls that the “crypto winter” could prove far shorter than feared. Bitcoin and other riskier assets have benefitted from growing confidence that global inflation rates, recently running at decades-long highs, are starting to cool.

Source: CoinMarketCap.com

Last week, the US consumer price index posted an inflation rate of 6.5% in December, the sixth consecutive month of decline. Aggressive interest rate hikes by the Federal Reserve and other major central banks like the Bank of England appear to be having the desired effect.

While Bitcoin was once put forward as a hedge against inflation, its movements in the past year have tended to be in line with interest rate expectations. Like other riskier asset classes, investors have been moving out of Bitcoin and other cryptocurrencies when the expectation has been for interest rates to rise.

When market sentiment has started to favour the likelihood of slower rate hikes and a lower high point being required to bring inflation under control, the Bitcoin price has dropped. Bitcoin began to tumble from its record high of nearly $70,000 in November 2021 when investors reached the conclusion soaring inflation would not be the short term post-pandemic phenomenon economic consensus first expected it to be.

Positive economic sentiment supporting Bitcoin price recovery

Nikolaos Panigirtzoglou, JPMorgan’s managing director for alternative and digital assets commented this week that the rally across most major asset classes this year has been based on hopes for ‘soft landing’ for the U.S. economy and also boosted crypto sentiment. He sees the softening of the dollar from 2022 highs are another factor in favour of further Bitcoin price rises. The trend has catalysed rising prices for commodities including gold which has, he says, helped “reprice Bitcoin as a substitute asset class”.

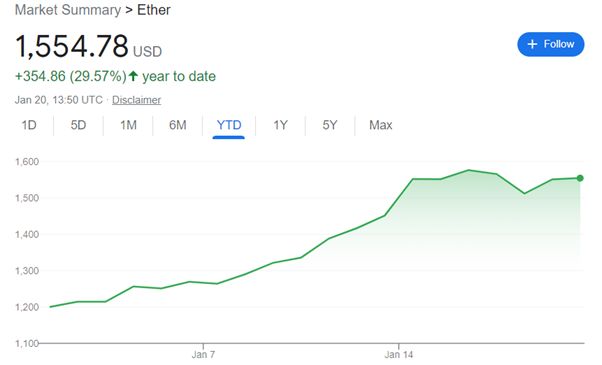

Bitcoin’s positive recent momentum is being mirrored by other major cryptocurrencies such as Ether, which is up almost 30% since the beginning of January. Unlike Bitcoin, Ether is seen as a utility coin rather than a potential alternative to fiat currencies or store of value. It is used to pay for computing power bandwidth on the Ethereum platform which many crypto and blockchain projects are built on. That ties demand for Ether tightly to overall crypto and blockchain-sector activity.

Overall, the market value of the top 500 crypto tokens has risen back to $1tn from $830bn at the end of last year but remains well off its November 2021 peak above $3.2tn. That upward momentum has, details a report from crypto investment service BitStacker, saw Bitcoin shorter lose in $386.74 million in position liquidations between January 10 and 16.

Kris Lucas, an analyst at BitStacker quoted by the Independent newspaper, comments:

“While it’s always sad to see traders losing money on their investments, the study does show that cryptocurrencies might finally be bouncing back. 2022 was a very tough year for cryptocurrencies with the collapse of several major exchanges, as well as the Terra stablecoin. However, the fact that bitcoin is starting to regain its value could suggest that the so-called crypto winter could soon be over.”

Could Bitcoin’s recent upward momentum prove to be a bear trap?

Despite a positive start to the year, confidence in crypto markets remains fragile. Investors remain wary of further sudden shocks after the collapse of Sam Bankman-Fried’s FTX. Another potential shock on the horizon is the fate of Genesis, one of the biggest lenders in the crypto market.

It froze customer withdrawals at its lending unit in November after FTX’s failure, blaming “unprecedented market turmoil” and owes its creditors more than $3bn. Its parent, crypto conglomerate Digital Currency Group, is trying to raise the capital required to prevent Genesis being forced into bankruptcy. However, some analysts believe that Genesis collapsing has already been priced into the crypto market so that fate being confirmed would not have a major negative impact on prices.

There are also analysts who believe a good part of Bitcoin’s gains this week are a direct result of short sellers being forced to liquidate positions.

The Financial Times quotes David Moreno Darocas, research lead at data provider CryptoCompare, also injects a word of caution on how long lived the early 2023 Bitcoin rally may prove to be:

“Some upside volatility was due to come eventually and does not mean that this move upwards will be sustainable.”

The fragility of recently more positive crypto sentiment was also highlighted this week when the U.S. government announced a press conference for some major crypto-sector news, resulting in a $1000 Bitcoin price flash crash in less than an hour. In the end, it turned out the news was positive, announcing the breakup of a major crypto crime network and the Bitcoin price quickly moved into a bullish trajectory again.

However, the sharp movement down demonstrated the fragility of positive sentiment and calls into question if the current bear market’s bottom was indeed reached late last year. Despite that, January has been the best few weeks from the crypto market in nearly a year.

Nigel Green, CEO of financial advisors deVere Group told the Independent he believes improved inflation data points to better times ahead for Bitcoin:

“We are technically still in a bear market, but the signs are the bulls are beginning to take back control.”

Bitcoin bears are convinced it’s not a question of when the leading cryptocurrency goes to zero, not when a bull market returns

Crypto market sceptics, however, remain convinced any current upwards momentum for Bitcoin is simply delaying its inevitable decline towards irrelevance and a value of zero. While the American banking giant JPMorgan is very much hedging its position on cryptocurrencies, it is actively developing blockchain technology being integrated into its services and has created its own token (JPM Coin) used for intraday repurchase agreements, its CEO is a vocal critic of the sector.

In a wide ranging interview for the CNBC show Squawk Box given at the World Economic Forum in Davos, Dimon responded to a question on Bitcoin with his own, querying what they would “waste any breath” discussing the cryptocurrency. He then did waste a little more breath to disparage Bitcoin as “a hyped-up fraud, a pet rock.”

Pressed further on whether he considered the entire crypto sector a Ponzi scheme, Dimon responded:

“You guys have all seen the analysis of TetherUSD and all these things, the lack of disclosures, its outrageous. Regulators should have stopped this a long time ago. People have lost billions of dollars if you look at its lower-income people, in some cases retirees.”

The dissonance between JPMorgan the bank’s active hedging for that cryptocurrencies will make a comeback and establish themselves as fixture of financial markets, it even registered a trademark for a cryptocurrency wallet in late 2022, and its CEO labelling the whole sector a Ponzi scheme, can be seen as a microcosm for broader attitudes. Individuals have their opinions but when the future of corporations are at stake, few are willing to bet too heavily on either camp being proved right.

It’s still very hard to call if, in the long term, Bitcoin’s days are numbered or if it will finally establish itself once and for all. In the meanwhile, barring any major new developments not yet on the radar of investors and market observers, it seems likely that the Bitcoin price will continue to show close correlation with other riskier asset classes.

If economic data continues to improve and the U.S. avoids a painful recession, that is likely to continue to support the positive momentum Bitcoin has enjoyed so far in 2023. If it, and crucially market sentiment, turn more negative again, the recent rally could quickly run out of steam.