Investing in China is a decision to weigh up carefully. But after over a year of steep falls for Chinese equities between July 2021 and late October this year, high-profile fund managers are putting their faith, and money, back into the world’s most populous country.

This week Bloomberg reported that two veteran fund managers, Franklin Templeton’s Manraj Sekhon and Bill Maldonado, CIO at Singapore’s Eastspring Investments, have joined a growing list of asset managers buying up Chinese equities. The bet is Beijing moves away from the Covid Zero policy that has disrupted supply chains since 2020 by reducing China’s manufacturing output and the broader economy.

Source: Yahoo Finance

The change in market sentiment towards China by international money managers has seen the MSCI China index gain almost 25% over November so far. The MSCI World index is up just 5% over the same period.

Maldonado reasoned, in the wake of his decision to invest in China again:

“The worst is already priced in and you’ve got plenty of upside. You’d be buying now and expecting things to kind of rebound on a three-to-six-month basis.”

Templeton’s Sekhon was even more directly bullish, commenting “it’s time to get involved in China if you haven’t already.”

But Chinese equities are still viewed as an exotic and risky market by most retail investors and one relatively few are exposed to. There are good reasons to view Chinese equities as risky, not least as evidenced by the market’s recent 60%+ slump. But that doesn’t mean they don’t hold plenty of potential too, especially at current price levels and after what looks like it might be the start of a strong market recovery taking hold this month.

For investors who might want to take Franklin Templeton’s Sekhon at his word and “get involved in China”, what are the risks to consider and the factors that also mean a growing number of experienced fund managers see them as worth taking?

The risks posed by investing in China

Geopolitical tensions between China and the West, centred around Taiwan but extending to a struggle for power, influence and access to natural resources and trade corridors in South East Asia, the Pacific, Africa and elsewhere, will be a risk for the foreseeable future.

There’s also the risk of the trade war between the USA and China stoked during the Trump presidency of the former reigniting. That was highlighted this week when Trump announced his candidacy to run for the Republican nomination for the 2024 presidential election.

Is Beijing’s domestic policy as big a risk as potential geopolitical flashpoints?

Internal politics are a further risk to investing in China. The MSCI China index slumped by over 60% between early July 2021 and a recent low on October 23 this year and that precipitous drop was caused by a number of factors closely related to Beijing’s domestic policy.

The first was the bursting of the country’s housing bubble and loss of faith in the financial strength of construction companies following the well-publicised collapse into receivership of Evergrande, the country’s second-largest property developer. While officially a private company, Evergrande and China’s other giant construction companies have always been heavily linked to the state and it was presumed the state would intervene to bail it out when it announced liquidity problems last year.

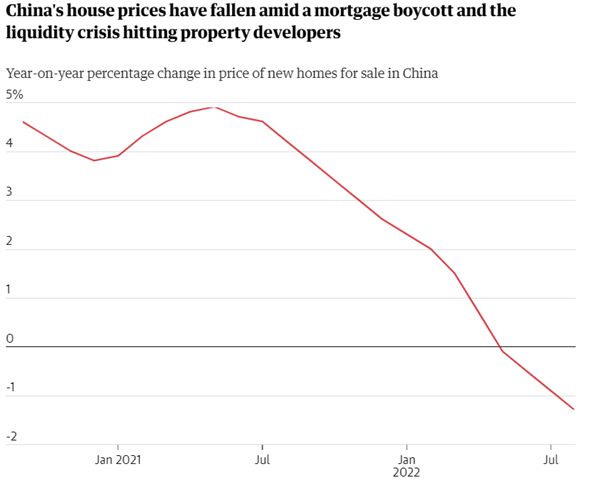

Chinese faith in construction companies and the property sector has been eroded and the result was a worse-than-expected 1.3% year-on-year drop in prices over the 12 months to August. That’s according to official figures with suspicions the real state of the market, until recently a seemingly unstoppable engine of growth, could be worse.

Source: The Guardian

Research by Citigroup published by the Guardian newspaper in September found that nearly a third of all property loans in China were by then classed as bad debts – 29.1%, up from 24.3% at the end of last year. That increase has been driven by property developers rather than homeowners.

Despite recent commitments by Beijing to invest £26 billion in kickstarting the country’s housing market, things don’t look good. Around 2 million off-plan homes, in 2021 90% of new homes in China were sold off-plan, remain unfinished across China, according to a rough estimate by S&P. That figure will grow if sales continue to fall and developers continue to run out of money to complete projects.

S&P wrote:

“China’s property downturn has turned into a crisis of confidence that only the government can fix. If falling sales tip more developers into distressed territory, things will get worse.”

The issue stems from the decision taken by President Xi two years ago to clamp down on the “reckless” levels of debt being built up by property developers. But since the lending to these companies stopped, many haven’t had the liquidity to finish the properties they already had under construction. The cash raised from off-plan sales had already been re-invested in buying the next piece of land or starting construction on the next project.

President Xi and the Chinese Communist Party more broadly have not only cracked down on the property sector over the past couple of years. China’s authorities became concerned about the growing power and influence of the largest companies in the private sector more generally, and their hugely wealthy owners.

The tech sector, which many of the country’s biggest companies like Alibaba, Tencent and TikTok-owner ByteDance belong to, was another high profile target. Chinese internet companies contribute 20% of the aggregate net profits of China’s top 500 companies. However, a government crackdown which often seemed indiscriminate and without any obvious pattern or internal logic, sent out a message to companies and wealthy owners about who is ultimately in charge.

The crackdown has forced major companies, including Alibaba and Tencent to cut jobs over the past couple of years. Some of the other major repercussions were listed by Axiom China as:

- Food delivery giant Meituan lost half its market value — tens of billions of dollars — last year after regulators required food delivery apps to cut their fees.

- After riding hailing app Didi went ahead with its New York initial public offering (IPO) despite a warning from China’s cybersecurity watchdog, regulators issued fines, temporarily prohibited new user sign-ups, and embedded government officials directly within the company’s ranks. Didi also lost billions in market value.

- Regulators also halted the planned IPO of Alibaba’s finance arm ANT Group, at the time projected to be the largest IPO in history.

Last month, after changing the country’s constitution to secure a third term, President Xi Jinping effectively secured ultimate power for life and filled the country’s highest decision-making body with loyalists. Fears of tighter government control over businesses resulted in multiple stock market drops in the aftermath of the Chinese Communist Party Congress in October which cemented President Xi’s power.

The third major domestic policy to hit Chinese stock market valuations has been the country’s Zero Covid policy. Outbreaks of the Covid-19 virus in factories or elsewhere in the country have resulted in strict lockdowns that have seen workers locked into factories for weeks and neighbourhoods or whole cities cut off from the outside world.

That has hit the country’s GDP with a recent Reuters poll forecasting growth of 3.2% for 2022, well below the target of 5.5% and meaning the year will show one of the worst economic performances in almost 50 years.

Analysts are split on whether the Zero Covid policy will continue or not. Some have expressed the opinion there are signs there may be a pivot. However, Julian Evans-Pritchard, senior China economist at Capital Economics, predicted in late October:

“There is no prospect of China lifting its zero-COVID policy in the near future, and we don’t expect any meaningful relaxation before 2024. Recurring virus disruptions will therefore continue to weigh on in-person activity and further large-scale lockdowns can’t be ruled out.”

How big are the risks?

That investing in China necessitates taking on some significant risks is clear. However, there are also strong counter-arguments that short of a very serious incident such as an invasion of Taiwan, exposure to the world’s second-largest economy, offers serious potential upside investors should think carefully about ignoring.

China seems to have little economic incentive to make a move that would separate its economy from the Western markets it still very much relies on. This means the general consensus is that while it will continue to flex its growing geopolitical and military muscle in its region and beyond, and there are likely to be standoffs, any outright conflict is unlikely. At least in the near to medium term.

The tight control the authorities exercise over the economy also means it can be expected to continue to intervene, even if it periodically sends strong messages to the private sector and will seek greater involvement. Every time the economy has started to slow, there has been intervention and that can be expected to continue. This year a raft of stimulus initiatives have been launched.

Hao Zhou, chief economist at Guotai Junan International says:

“On the policy front, the overall policy will remain supportive. In our view, further policy impetus is required to buoy economic recovery, but additional interest rate cuts are unlikely during a period of aggressive global central bank rate hikes.”

The property market has also shown some recent signs of stabilising and even if more cash than has been promised by authorities is thought to be required, it is unlikely any large-scale meltdown will be allowed to happen. Chinese households losing a level of trust in property could also have a positive impact on equities.

Bloomberg reported the brokerage and investment group CLSA as predicting Chinese households will move 127 trillion yuan, £14.8 trillion, out of property over the next nine years and into other investment classes like equities, funds and bonds. If that happens, even to some extent, it would be a big boost to stock and other financial markets.

There are also hopes the property crisis is coming to an end. On Monday November 14, shares of China’s biggest property developer Country Garden leapt as much as 52% in Hong Kong after Beijing unveiled a 16-point plan ahead of the weekend that significantly eases a crackdown on lending to the sector.

Measures include allowing banks to extend maturing loans to developers, supporting property sales by reducing the size of down payments and cutting mortgage rates, boosting other funding channels such as bond issues, and ensuring the delivery of pre-sold homes to buyers.

Harry Hu, chief China economist for Macquarie Group is quoted by CNN as saying

“in essence, policymakers told banks to try their best in supporting the property sector”.

There are also hopes the crackdown on the tech sector may have ended for the foreseeable future, even if Beijing is likely to demand greater influence in how they are run. China bulls are convinced market capitalisation losses over the past two years mean China’s tech company’s are now extremely cheap. Eastspring’s Maldonado comments:

“Valuations had gotten very cheap and earnings expectations had gotten very, very low.”

Anand Batepati, portfolio manager at GFM Focus Investing, also recently told CNBC’s Street Signs Asia show that Tencent and Alibaba are “extremely strong companies” and that “unless you think that the government or some external force is going to destroy 90% of their existing business, then I think it’s a no brainer”.

He continued:

“Unless somebody thinks that the government is going to come and expropriate these companies … I think over the next three to five years, China’s tech sector could see another huge level of growth.”

Should you consider investing in China?

A long term investment in China is a bet that the huge country will not pursue a strong isolationist agenda over the next several years. That is certainly not impossible but it also looks relatively unlikely, for now. There are hopes that this week’s meeting between Presidents Biden and Xi at the G20 summit might signal a thawing of relations, based on an understanding in both countries that tensions ratcheting up is not in anyone’s interests.

There does look like a good chance China’s stock market may have started out on a sustainable recovery this month and if that continues it may well be among the best performers internationally over the next year or two. That might prove a very tempting prospect amid the doom and gloom elsewhere for investors with a healthy appetite for risk.

China is likely to split investment experts for years to come. The potential is clear. As are the risks.