Netflix investors have had a rollercoaster ride over the past year. Between the end of October 2021 and June this year, the television and film streaming company, the N in the FAANG group of big tech stocks, saw its valuation plunge by almost 75%. But gains of over 23% last week after the company announced a return to growth after a tough post-pandemic period mean the Netflix share price has now recovered by almost 75% since.

With a current share price of $289.57 compared to a high of $690.31 at the end of last October, Netflix’s valuation is still a long way away from the giddy levels reached before the stock market slump of 2022. However, it’s also a hugely altered environment for stock and financial markets more broadly.

The record highs the Netflix valuation reached last year were clearly, in retrospect and in validation of the voices who cautioned to that effect at the time, the result of a melt-up that was the final act of the longest bull market in history. Market fervour typical of the culmination of an extended bull market was amplified by the unique conditions created by the Covid-19 pandemic to create a growth stocks bubble.

The impact on Netflix’s valuation was especially pronounced because it had been one of the digital economy companies to benefit most from pandemic conditions which curtailed social activities. Consumers stuck at home as a result of lockdown restrictions increasingly turned to entertainment and activities that didn’t involve mixing in public and Netflix subscriber numbers soared as a result.

The company warned at the time there would be an inevitable hangover as a result of new subscribers bringing forward the decision to take a Netflix subscription. That front-loaded growth across 2020 and 2021, which would otherwise have been expected to be more spread out. Netflix’s caution was, however, ignored by investors who piled into the stock, driving the company’s share price to nosebleed heights that could only be justified by strong growth continuing.

When growth inevitably slowed from late last year and then turned negative in 2022, the Netflix share price plunged. This year the pandemic-growth hangover has been further amplified by increased competition from new streaming rivals including Disney+ and a tough macroeconomic environment of the highest inflation rates in decades combined with rising interest rates.

Netflix returns to growth

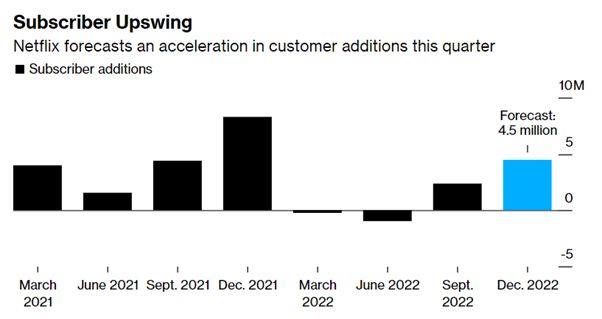

But in its most recent set of quarterly results, published last week, Netflix returned to growth and forecast the quarter will see it add a net 4.5 million new subscribers. The quarter to the end of September saw 2.4 million new subscribers added after negative growth over the previous two.

Source: Bloomberg

From the positive position of a new record base of 223.1 million paying subscribers, the company told investors:

“After a challenging first half, we believe we’re on a path to reaccelerate growth.”

Markets reacted to the positive update by indicating the new evidence presented suggested the stock may have been oversold over the past 12 months. The Netflix share price immediately leapt 14.4% in after-hours trading after the quarterly report was delivered and had extended those gains to 23.35% by the end of the week.

Overall, despite a 4% drop in net income to $1.4 billion as a result of heavy investment in new content, Netflix outperformed analysts’ expectations for the quarter with a 6% rise in revenue to $7.93 billion.

Can Netflix maintain a strong rate of growth again going forward?

Growth over the coming months, though the company cautioned the move will not materially impact results over the current quarter, will be largely defined by the success of the company’s pivot away from a subscription instead of advertising model. In an effort to reignite growth, Netflix has embraced a strategy it long resisted – traditional advertising.

Viewers unwilling or unable to pay the monthly subscription rate for an advertising-free experience will now be able to opt for a new, cheaper rate in exchange for the introduction of ads. The move back towards the traditional revenue model for broadcasters hopes to tap a new, more cost-sensitive segment of the market and will be introduced to the UK early next month.

The company commented on the move:

“Our aim is to give our prospective new members more choice — not switch members off their current plans. Members who don’t want to change will remain on their current plan, without ads, at the current price.”

Netflix is also tightening up its approach to password-sharing, which it has been traditionally lenient with on the presumption it was an effective form of popularising the service. An estimated 100 million households are believed to be piggybacking on the subscriptions of friends and family and not paying to watch the Netflix film and television catalogue.

Despite last week’s positivity, Netflix’s co-founder and Chairman Reed Hastings described projected growth for the rest of 2022 as “not fantastic, but reasonable”. The difficult first half of the year will also almost certainly mean 2022 represents the company’s slowest year of growth in a long time.

The strength of the dollar is also an issue and is expected to hurt revenues generated in other currencies, which account for a lot of the company’s income, when converted back to dollars on the balance sheet.

However, in the pluses column is the forecast Netflix’s new advertising business will benefit from scooping up billions of dollars previously spent by advertisers on live TV channels as linear TV audiences plunge. The new lower-cost ad-supported Netflix subscription will be rolled out across 12 countries from November 1. These markets, said the company,“account for ~$149 billion of brand advertising spend across TV and streaming, or over 75% of the global market.”

Netflix will be confident its new pricing tier will help it scoop up several billion of that overall spend.

With advertising revenue growth in mind, the company is also moving to a new reporting model that will focus more on traditional fundamentals like revenue and operating income. In that vein, it will no longer include forecasts for new subscriber numbers for the quarter ahead when it reports, though overall subscriber numbers will still be published every three months.

How much upside could still be left for the Netflix share price?

On the back of a return to growth, a new long-term strategic focus on revenue and free cash flow growth rather than subscriber numbers and a price-to-earnings ratio currently 57% below what it was a year ago, should investors be considering Netflix shares again?

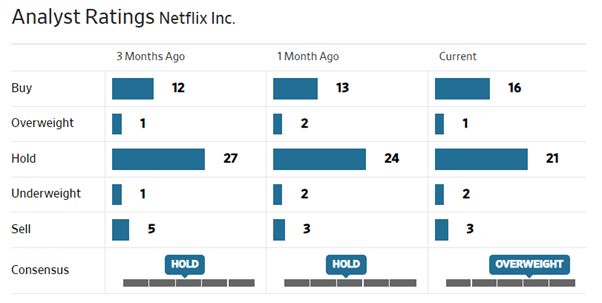

Several major Wall Street analysts, including those at JPMorgan Chase and Deutsche Bank, have upgraded their price targets for Netflix. Analysts surveyed by the Wall Street Journal have become more positive in the last month moving the stock’s overall rating from hold to overweight.

Source: Wall Street Journal

While the median price target for the next 12 months of $285 would represent a slight drop on the current Netflix share price of $289.57, more optimistic analysts have a price target of $365. That represents an upside of over 26% on the company’s current valuation.

The company’s prospects will be impacted by the broader macroeconomic environment and a competitive landscape in which it is battling it out with streaming rivals including Disney’s Disney+, Warner Bros. Discovery’s HBO Max, and Apple’s Apple TV+. However, unlike younger rivals who are now investing heavily in content and marketing as they play catch-up, Netflix is profitable, giving it an advantage.

Netflix may not be a clear and obvious share price winner over the next year due to the wider negative markets and economic environment. However, investors with a glass-half-full attitude towards the company may see its current valuation as an attractive entry point despite the strong recent gains. If the new ad-supported tier has the hoped for impact on revenue and subscriber growth, there should be healthy upside at the current valuation.

The risk is early results are disappointing a couple of quarters from now. That would dampen optimism again and could drag the company’s valuation back down.