It’s not news that 2022 has been a tough one for stock markets. There have been sectors, like energy and utilities, that have bucked the negative trend but the big picture has been bleak. The UK’s large cap FTSE 100 index has faired better than most and is more or less flat for the year thanks to its heavy weighting towards energy, industrial commodities, and finance.

Source: CSIMarket

But it’s been a volatile ride and the end of the year could still drag London’s benchmark index into the red.

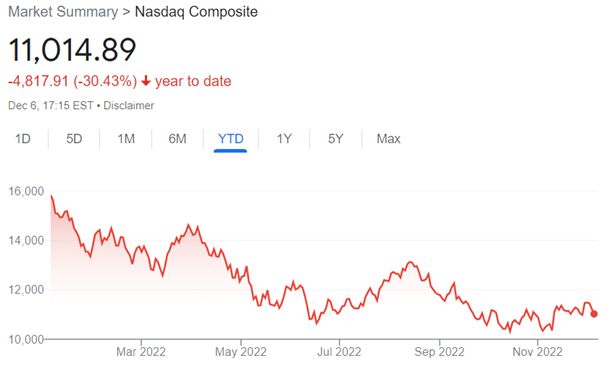

Over in the USA, the major indices have suffered significant losses. The growth companies, especially in the tech sector, that saw Wall Street enjoy over a decade of strong growth with only the occasional short-lived correction have been among those hit hardest by inflation hitting decades-long highs and interest rates rising.

That’s seen the tech-heavy Nasdaq Composite register an over 30% loss for the year-to-date and the broader based S&P 500 is down a little under 18% over 2022.

However, while the hangover from the Covid-19 pandemic and Russia’s invasion of Ukraine were unpredictable events that have undoubtedly deepened stock market losses, a turn of the market cycle is not a surprise. The bull market that preceded the 2022 bear market was the longest in history, supported by unprecedented levels of quantitative easing and record-low interest rates in major developed economies.

If anything, the surprise was that the bull market for equities persisted for as long as it did and pushed valuations so high. More bearish analysts had been warning of a reversal for years before it actually transpired.

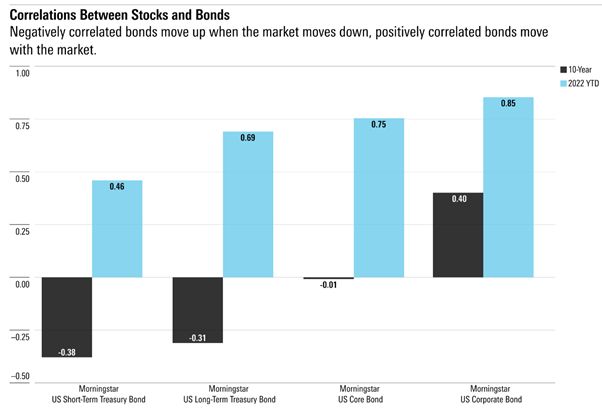

What has been far more surprising, almost unprecedented, is that bond markets have failed to live up to their traditional portfolio role of providing insurance against an equities bear market. When equities, especially growth stocks, enter bear territory, bonds usually go in the opposite direction, rising with interest rates and an influx of capital seeking a safe haven.

Traditionally, a portfolio with a 60% allocation to equities and 40% allocation to bonds should come into its own during periods like this year. The bond allocation would be expected to cushion the blow of an equities bear market, paying its way for lower returns than equities during the good times.

But in the third quarter of this year, a traditionally conservative portfolio with a 40% allocation to equities would have actually underperformed one 100% allocated to equities. Inflation remaining stubbornly high this year despite the Fed and other central banks including the Bank of England has upended the conventional investing wisdom that equities and bonds do not both move in the same direction – the foundational principle of traditional diversification strategies.

But will that change in 2023? Could bonds outperform equities next year in a way that means investors should consider increasing their portfolio weighting towards fixed-income investments?

Why have bonds not lived up to their billing in 2022?

Nothing has worked well for diversified investors this year, not equities, not bonds and not the traditional 60/40 portfolio split between the two asset classes. But will this year prove a blip or has the relationship bet equities and bonds changed fundamentally?

Analysts including Morningstar’s Lauren Solberg believe the performance of the bond market next year will be most influenced by inflation. If inflation remains high, bonds could continue to struggle alongside equities. However, if major central banks including the Fed manage to wrestle inflation back down towards target levels, especially if that is accompanied by a recession, bonds would be expected to revert to their traditional anti-correlation with equities.

This year, one they would have been expected to benefit from a flight from equities and rising interest rates, has been the worst for bonds in modern history. It’s also been the only time in history that stocks and bonds have both recorded losses for three consecutive quarters.

Source: Morningstar

Sky-high inflation, which is bad for both equities and bonds, has negated the usually positive impact on bonds of a bear market for equities and rising interest rates.

Will bonds return to form in 2023?

There is differing opinion among analysts and market observers about what 2023 might hold in store for bond markets. The more common expectation is that bonds will do a much better job at insulating portfolios than this year with yields now much higher than they were in late 2021.

However, others believe that a secular change in the correlation relationship between equities and bonds is now underway. That is based on the expectation that inflation, even if it falls meaningfully in 2023, could remain at higher levels and be more prone to volatility than it has been over the past couple of decades.

Recent research published by Truist Wealth shows that U.S. government-backed debt has delivered average annual returns of 6.6% over the past four recessions, beating both high-yield ‘junk’ and investment-grade corporate bonds. That would indicate 2023 could be a very good year for bond investors with the right exposure – a focus on government rather than private sector debt. However, we’ve already seen a significant divergence from historical patterns this year.

Marta Norton, chief investment officer for the Americas at Morningstar Investment Management, believes 2023 could be hold opportunities for fixed income, across government-backed and corporate bonds:

“When you look over the past 10 years, it’s really only been an equity story: It’s been such a good market to take on equity risk, a tremendously good time to be an equity investor. But today, it’s harder to know where to invest the marginal dollar. Fixed income is looking more appealing than it has in some time. You don’t have to take enormous risk to earn some return, and that’s a mindset shift to the environment we had before.”

While she acknowledges that U.S. equities now look a lot more attractively priced than they did a year ago, she cautions against investors rushing back to the market and thinks the bear cycle could last longer than many expect. She says the “buy the dip”mentality that has worked so well over the past decade could mean investors risk suffering meaningful losses by moving into a losing market.

She doesn’t advise not investing in equities but that investors should instead drip feed any investment instead of trying to time a bottom.

She is more confident in the opportunities around fixed income investments, especially higher-quality, shorter-dated fixed income, which she says comes with the added benefit of lower risk, especially if a deeper recession materialises.

Christian Mueller-Glissmann, head of asset allocation research within portfolio strategy at Goldman Sachs agrees. He notes the gap in yields between stock and bonds has narrowed substantially since the COVID-19 crisis and is now relatively low. The same is true for riskier credit, which yields relatively little compared with practically risk-free Treasuries and means investors are getting little premium for the risk of owning equities or high-yield credit in comparison to lower-risk bonds. As a result, equities and high-yield debt are particularly exposed to an economic slowdown or recession:

“That just makes equities and riskier debt very vulnerable for disappointments on growth next year”.

Lisa Shalett, chief investment officer of Wealth Management at Morgan Stanley is also championing bonds for 2023. She concludes:

“We continue to believe it is premature to call an end to the bear market for U.S. stocks. Investors may have moved on from inflation concerns, but they cannot ignore the economic picture. For now, investors should consider reducing U.S. large-cap index exposure. Instead, look to Treasuries, munis and investment-grade corporate credit. Stay patient and collect coupon income.”

What about UK Gilts vs London-listed equities?

Should investors mainly exposed to London-listed rather than Wall Street-based equities be thinking along similar lines? The FTSE 100 has remained largely flat in 2022, finally benefitting from its lack of growth stocks and heavy weighting to more traditional sectors like energy, commodities and finance.

London-listed equities were considered cheap before 2022, which is another reason valuations have not fallen in the same way as they have in the USA. On the other hand, they are also less likely to see as much upside if a recession is avoided next year and economic sentiment improves.

The FTSE 100 has also been boosted considerably by the soaring valuation of big energy companies like BP and Shell and utilities such as Centrica, which has compensated for companies in other sectors, such as consumer cyclicles, losing value. Energy prices easing off next year, which is by no means guaranteed depending on how geopolitical factors play out, would be negative for the benchmark index.

The UK’s outlook for both equities and government debt is not particularly positive. RBC Wealth Management summarises:

“A crippling cost of living, austerity measures, and the Bank of England tightening monetary policy will all conspire to create a prolonged recession in the UK, in our view. We advocate an underweight position in UK equities, although we are mindful that depressed valuations may produce interesting dividend income opportunities. We have a negative outlook on UK sovereign debt, as increased government debt issuance and the Bank of England proceeding to sell its Gilts portfolio will likely create a Gilt supply glut.”

While it may not appeal to patriotic sentiment, investors looking for the best risk-to-reward ratio in 2023 might be better served to invest in U.S. Treasuries than UK Gilts if a fixed income approach is favoured.