The global value of video gaming is overtaking every other form of mass media entertainment, including television

It’s not the first time I’ve written about the growth of the gaming industry in the context of the sector’s growth and investment potential. But the sector’s continued growth and evolution is both steady and impressive enough that it is a topic that calls for continued coverage.

The ongoing evolution and rise of video gaming as a commercial sector and significant branch of technology justifies it. The scale of the industry means it is one investors should keep a regular eye on.

The rise of video gaming – a high tech ‘toy’ has become a global pastime spanning generations

Like me, you may well have grown up in the 1980s or 1990s. Even if you are slightly older, you will have witnessed the birth of video gaming as a mass home entertainment market over that period. And if you come from a younger generation, it’s possible your parents, who themselves will have come of age in that period, still play video games. Or at least reminisce fondly about when they had the time to.

The 1980s saw the first generation of PCs and gaming consoles like the Atari, Commodore 94 and the ZX Spectrum that were cheap enough to become accessible to working class kids in the UK, USA and other developed economies.

Big arcade machines packing the computing power for even more impressive video games became a standard in public amenities like swimming pools, sports halls and leisure centres. Youths would pay coins into the machine with playing time usually tightly connected to aptitude at the game being played. Lose all three lives and you would have to put in another 10p or 20p to be resurrected.

For my generation, there was something special about these video games. They drew us in, becoming part of our lives and the topic of playground chat. And we knew it was new, developing technology we were both ecstatic to be enjoying and curious to see what came next.

By the 1990s, affordable 8-bit gaming consoles like the Sega Master System and NES (Nintendo Entertainment System) meant the level of game once only available on arcades could be played at home. And for as long as we liked (parental nagging aside), not limited by how many coins we had managed to wheedle from parents.

A few decades later, the kids of 1980s and 1990s have already hit or are approaching middle age and are parents themselves. Many of them never gave up gaming and still consider it a hobby or leisure activity to enjoy when the opportunity arises. The rise of smartphones also introduced both older and younger generations to video gaming, which was mainly the preserve of tweens and teens in the industry’s early days. Today, 35-44-year-olds own more gaming consoles than 16-24-year-olds.

As of 2023, over 3 billion people play video games globally, a majority on smartphones. Women play almost as much as men and half of 55-64-year-olds in the UK do too, albeit for less time than younger age groups.

Video gaming has become the most valuable of all mass market media, including television

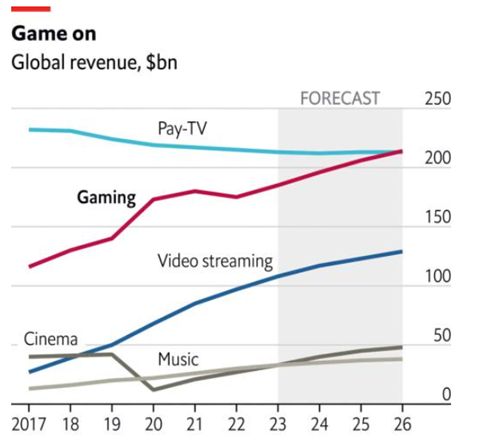

As a result, the industry has just kept on growing since the 1980s and it’s now worth several times what the music industry and cinema are. Video gaming brings in almost two thirds more revenue than video streaming. Globally, $185 billion is forecast to be spent on games this year, more than half on mobile games.

The value of hardware, accessories, and in-game advertising adds another $65 billion to that total. And by 2026, just three years from now, more money is forecast to be spent on video games than on Pay-TV.

Source: The Economis/Omdia

It’s hard to predict exactly how and how quickly new technologies such as Augmented and Virtual reality will shape the video gaming sector over the years ahead. Their integration into mass market video gaming has been slower than many predicted a decade ago.

In large part, that is attributed to the need for additional hardware that is still relatively expensive and bulky. Still low commercial demand for AR and VR-based gaming has in turn discouraged investment from gaming companies.

But VR and AR almost certainly will become increasingly part of video gaming over the next decade or two. At least, Facebook is so convinced of that trend it has gone in all in on it, even renaming the company ‘Meta Platforms’ after ‘Metaverse’ – the catch-all term for the still hazy future digital world that users will interact with, and each other, via VR and AR hardware.

The metaverse and mainstream adoption of AR and VR are still unknown quantities and, as such, can be seen as high risk from an investment point of view, particularly for retail investors. But in the here and now, there is a huge amount of money being made by video gaming companies releasing products for today’s array of mass market hardware including mobile devices, PCs and specialist gaming consoles.

Video gaming is such a large and relatively mature market today that it can already be considered one it makes sense for investors to have at least some exposure to. That’s reinforced by expectations for continued sector growth for the foreseeable future.

There are lots of ways to gain investment exposure to the video gaming industry

In 2023, most active investors and invested pension holders will have a level of exposure to the gaming industry, even if not directly aware of it. Almost all of the world’s biggest tech companies have significant interests in gaming, none more so than Microsoft, the world’s second largest company, worth $2.09 trillion.

Microsoft has been in the gaming sector since 2001 when it launched its Xbox console and has been investing in the fast-growth sector heavily since. Last year it struck a $69 billion deal for the game developer Activision Blizzard. If antitrust regulators finally approve the acquisition, which they have pushed back against, it will be one of the biggest tech deals in history.

Apple, the world’s biggest company with a market capitalisation of $2.59 billion is also heavily invested in the gaming industry, mainly through distribution via its AppStore for mobile applications. It’s also investing in developing its own cloud-based games streaming platform, Apple Arcade. For a monthly payment of $4.99, subscribers can access over 200 games in a Netflix-style model.

Google also distributes mobile games through its Play app store for Android devices and also launched its own cloud streaming platform for games – Stadia. The Stadia project has since been abandoned after failing to quickly gain enough traction but it is surely only a matter of time before streaming subscriptions becomes a standard business model in video gaming.

Other tech giants probing the games streaming market include Amazon and the chipmaker Nvidia. China’s tech titans are even more focused on gaming and Tencent, the country’s most valuable company, has built its business around mobile gaming.

Is the tech sell-off an opportunity to buy into video gaming stocks?

Like the rest of the tech growth sector, video gaming stocks and broader-based tech companies with significant exposure to gaming, have seen their valuations hit since mainly peaking in late 2021. While many have seen strong gains again this year, valuations are still typically significantly down on where they were a year and a half ago.

While many, like other growth stocks, looked overvalued before those declines, their futures also look bright and the current pricing of high quality video gaming stocks could present an opportunity.

Last year consumer spending on gaming fell for the first time in a long time but there were several extenuating factors. Inflation has hurt consumer spending and the end of the Covid pandemic and lockdowns saw more social, physically present forms of entertainment bounce back. Apple introducing stricter privacy rules for advertisers to contend with also made it harder for especially mobile games to attract new customers and supply chain issues limited supplies of new consoles.

But growth is expected to return this year and stay strong over the next several years. In 2023, gaming is forecast to grow faster than any other entertainment vertical.

Investors keen on exposure to the video gaming industry’s expected growth can either gain it via more diversified tech companies like Microsoft, Alphabet (Google) and Apple. Or they can look at more direct exposure via games developers such as Roblox Corporation (behind the hugely popular Minecraft game), Electronic Arts (FIFA, Sims, The Need for Speed) and Take-Two Interactive (Grand Theft Auto, Civilization). There are many more publicly listed games developers, large and small.

If video gaming isn’t currently part of your portfolio’s make-up, it’s not too late with plenty of sector growth still seen as remaining over the next decade and beyond. If you haven’t already, it may well be time to take a closer look at the sector. Especially with valuations significantly down over the past couple of years but starting to rise again, even if broader market conditions mean there could be a few bumps still on the road to recovery.