The Alphabet share price is down 32.09% so far this year knocking around $618 billion off the Google-owner’s market capitalisation. The drop in Alphabet’s valuation can be seen as the result of two main factors. The first is that this year’s decline is at least partly a natural correction after Big Tech valuations went into melt-up during the pandemic.

The second influence has been a slowdown in revenue growth to its slowest rate since 2013 (6%), excepting a brief period during the pandemic, and concerns over the financial impact of a global recession on digital advertising revenues.

However, at the current share price of $98.46, there is a strong feeling Alphabet has been heavily oversold despite recent gains. That also appears to be a growing feeling among fund managers, who have catalysed the recent rally by buying up swathes of Alphabet stock in recent weeks.

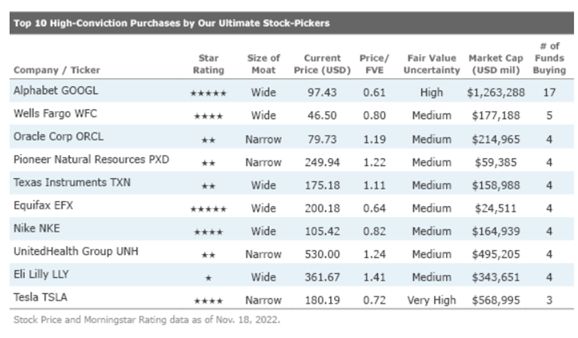

An article by the financial markets and funds data company Morningstar this week ranked Alphabet at the top of a table of “high conviction purchases” by tracked investment managers. Managers 17 funds tracked by Morningstar have made what the data company defines as purchases of Alphabet stock that represents a meaningful addition to their portfolios, judged by the size of the purchase in relation to the portfolio’s size.

The second most popular stock in the table for high conviction purposes was the U.S. bank and financial services company Wells Fargo, with 5 fund managers taking on significant exposure to the company. Alphabet is also currently given a rare 5-star rating by Morningstar’s inhouse analysts, indicating they see it as having limited downside and significant upside at its current valuation.

Source: Morningstar

Why is Alphabet seen by many professional stock pickers and analysts as undervalued?

Even if Alphabet is attracting investor attention at its current knock-down valuation, markets are still sceptical overall. If they weren’t, the company’s valuation would be higher. So while some fund managers have been making major recent investments in Alphabet, reflected by an 18% gain in the share price since November 3, the mainstream is yet to be fully convinced.

Is that simply because investors buying the stock now are cleverer than the wider market which is proving slow to appreciate it has oversold Alphabet? Or are those investors taking a significant risk with their glass half-full view of the company’s prospects over the near to mid-term?

Morningstar points out its analyst Ali Mogharabi estimates fair value for Alphabet shares at $160. That’s 62.5% higher than the current share price of $98, suggesting significant potential upside.

Mogharbi’s fair value estimate of an Alphabet share price of $160 is based on the strong revenue growth and cash flow generated by the company’s 80% share of the global search engine market held by Google. 85% of Alphabet’s revenue is still generated by digital advertising on Google, its associated ad platforms and YouTube.

The remaining 15% comes from a combination of sale of income generated by apps and content on Google Play, its quickly growing cloud service, licensing fees (especially for the Android mobile operating system), and hardware sales. Alphabet also has a loss-making “other bets” division that invests in future technologies and includes companies like the self-driving cars software company Waymo and life sciences company Verily.

Mogharbi expects Google’s dominant position in the search engine market to mean it will continue to see revenue and cash flow growth in future years with no obvious competition in sight. He believes future bets investments are reasonable as long as they are not to the extent they significantly compromise group-wide operating margins and profitability. Especially as there is a reasonable chance some might eventually contribute significantly to future revenues.

Waymo, which is developing an operating system for self-driving cars it hopes will mimic the success of Android for mobile devices, is expected to be a major player in a market worth tens of billions within the next ten to fifteen years.

But future bets aside, Mogharbi expects revenue growth from digital ad sales to maintain average annual double-digit growth for the next five years as mobile usage increases, even taking into consideration the potential for a slowdown next year as recession hurts global economies. He also sees video-content platform YouTube as contributing more to the top and bottom lines over the next few years despite the recent deceleration of its revenue growth.

And the Google Cloud Platform (GCP) is put forward as a strong business that will become increasingly important as it continues to grow. Revenue was up 38% year-on-year to $6.9 billion in Q3 and unlike its two larger competitors, Amazon Web Services and Microsoft’s Azure, Google Cloud is still losing money.

GCP should move into profitability in the medium term, the operating margin has recently shrunk from -14% to -10%, which would boost the group’s value. It is unlikely to ever be as big as AWS or Azure but could still be a major contributor to the bottom line within the next 5-10 years.

Alphabet is also responding to calls from activist investors to tighten its belt by reducing spend on future bets as well as staff numbers and remuneration levels. That should improve margins again and see the company emerge leaner from the current economic slowdown.

The company is also still a cash machine, which is facilitating a strong share buyback policy. Over the last year, the company has repurchased 433 million shares, spending $43.9 billion over the last nine months. Those repurchases reduced its share count by 3.2%, and with the stock price down and $116 billion in cash and equivalents on the balance sheet, the company could get more aggressive with the repurchases, which will help increase earnings per share.

That would be expected to put Alphabet in a very strong position to see its valuation rebound quickly when the cyclical market for online ads turns positive again.

The Alphabet share price also simply looks incredibly good value at its current level. On a trailing basis, it is trading at a price-to-earnings ratio of just 19.5. That’s even lower than the average 20.5 across the broad S&P 500 index which, based on Alphabet’s continued profitability, remaining growth potential, market dominance and balance sheet, just seems strange.

Risks to Alphabet share price upside

The main short term risk to the Alphabet share price is the potential depth of the global recession most economists agreed we have already entered. If the economic slowdown around the world proves more severe than expected and digital ad spend drops more as a result, markets could foreseeably punish Alphabet again and drag its value down.

Longer term, the company is still heavily reliant on digital advertising revenues and it will be a long time before that might realistically change. While some of the company’s future bets, especially Waymo, look very promising, there is still growth potential in the online marketing sector and existing businesses like Google Cloud Platform should make a much bigger contribution over future years, it is hard to deny Alphabet has a lot of its eggs in one basket. That does have to be seen as a risk.

However, overall, while the year ahead poses some downside risks, it does seem hard to imagine the Alphabet share price not rising significantly from current levels over the years ahead. At under $100, the Alphabet share price has a lot going for it.