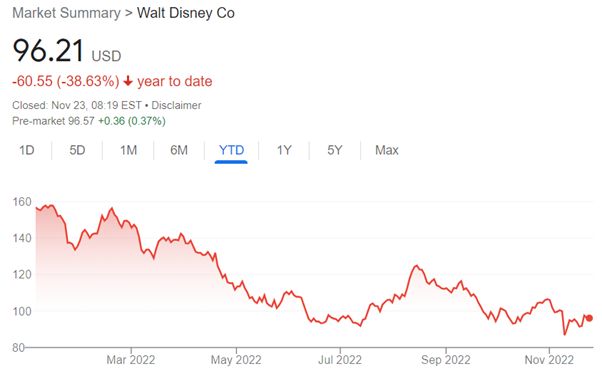

Like many of the stocks to do particularly well during the Covid-19 pandemic, Disney has struggled since with its share price down 38.63% this year. The multinational mass media and entertainment company’s valuation is down by over 51% since its high point of $197.16 set in March 2021.

Despite the positives like the Disney+ streaming service that rivals Netflix beating expectations by announcing year-on-year growth of 39% to reach 164.2, the Disney share price fell 6.9% after quarterly result were announced earlier this month. At one stage during after-hours trading the evening after the announcement, it dropped as low as $93.

Overall earnings and revenues disappointed investors with a $1.5 billion loss for the streaming division that also includes the sports broadcaster ESPN taking the shine off the success of Disney+ adding millions of new subscribers at an accelerating pace.

Despite total revenue rising by 9% to $20.15 billion during the three months to October 1, largely thanks to a strong post-pandemic recovery for Disney’s theme parks, the total fell short of analyst expectations for $21.2. Net income increased by 2% to $162 million.

Despite then chief executive Bob Chapek impressing that the streaming business was on course to reach profitability by 2024 “assuming we do not see a meaningful shift in the economic climate”, markets punished the Disney share price by dragging it to its lowest level since the February to March 2020 Covid sell-off. Of particular concern was the spiralling cost of ESPN’s investment in sports rights.

Bob Iger makes a comeback to replace Chapek as Disney’s new old CEO

What wasn’t expected in early November was that within a couple of weeks, Disney would have a new chief executive in the place of Chapek. The identity of Chapek’s replacement would come as a particular surprise. But 71-year-old Bob Iger, the veteran Disney chief executive that handpicked Chapek as his replacement upon announcing his 2020 retirement after 15 years in the hot seat has indeed been tempted back.

In an email to Disney staff, Iger told them he viewed his reappointment to the top job

“with an incredible sense of gratitude and humility — and, I must admit — a bit of amazement.”

The market also reacted positively to news the Disney boss that presided over a period of impressive growth fuelled by acquisitions suck as Pixar, Marvel Entertainment and 20th Century Fox had been reappointed. The company’s share price leapt 10% when Iger’s return was announced before eventually closing the session to a 7% gain. PP Foresight analyst Paolo Pescatore is quoted by The Times as commenting:

“The bold move [Iger’s return] might feel like the right one. However, the business is at a different phase of growth.”

Wells Fargo analysts were even more emphatic, writing the move

“puts perhaps the best leader in Media at the helm with a mandate to shake things up.”

Netflix co-founder Reed Hastings made perhaps the most telling contribution to the return of Iger to the company that owns the streaming giant’s most serious competitor when he tweeted:

“Ugh. I had been hoping Iger would run for president. He is amazing.”

What must Iger fix at Disney to set it back on track?

Put most simply, Iger’s job in his return to the role of Disney chief executive is first to stem losses and then to restore profitability. It can be presumed that a review of the company’s approach to acquiring expensive sports rights will figure prominently in both stages of the hoped-for turnaround.

The activist investor Daniel Loeb, whose Third Point investment group is a significant shareholder in Disney and was given a seat on the board in August, wants to see ESPN spun off. Another major step towards profitability for Disney+ will hopefully be the introduction next month of a new cheaper advertising-funded subscription tier. Netflix has just launched its ad-supported tier in the USA, charging $6.99 per month compared to $15.49 for its standard ad-free subscription and $19.99 for a premium account.

Iger, who is reported to have had doubts about his choice of Chapek as his replacement after the pair clashed during the transition period, is seen as having stronger relationships with Hollywood executives and a better intuition when it comes to the creative side of the business. His major Hollywood acquisitions all contributed significantly to Disney’s growth under him during his previous period in charge.

It can also be presumed he will more successfully avoid distractions such as Chapek’s public culture war with Florida’s outspoken Republican governor Ron DeSantis over what teachers in the state can say on LGBTQ+ topics. There was also an embarrassing legal dispute with Scarlett Johansson, star of Disney’s Black Widow film, over the decision to release the production in cinemas and over its streaming platform simultaneously. There’s a strong feeling the situation would have been nipped in the bud under Iger.

Can Iger work some of his old magic in just 2 years?

Investors wondering if the current Disney share price represents an improved upside under Iger should start the thought process in the context that the old new chief executive has said his return will only be for 2 years. The question is how much can he get done in that time and if the next choice of his successor will prove a better one than Chapek ultimately proved.

Stemming streaming losses while still catching up on Netflix’s global market share will be the big challenge for Iger.

Disney+

The days of “growing streaming at any cost” are over for Wall Street, and Disney’s leadership under Iger will have to prove to investors that Disney+ can achieve profitability relatively quickly while also continuing to grow. This will move the needle on Disney’s share price more than anything else Iger might achieve.

Sports and films

Previously seen as a valuable asset, ESPN has been losing viewership recently despite huge investments in sports rights and that has been hurting the business. That’s the crux of Loeb’s argument the business should be “spun off to shareholders with an appropriate debt load”.

He’s since stepped back from that demand since being given a seat on the Disney board but the point was made and Iger will have to show he can make money from ESPN again.

Another issue is the revenue being generated by Disney’s film studios. In the year before the pandemic and Iger originally stepping down, Disney released seven films that each hit $1 billion in global box office takings. This year only two Disney releases have achieved the same level of success.

Iger must ask and answer the question of if streaming and the pandemic have permanently changed the landscape for cinema releases and adjust Disney’s strategy accordingly.

Can Iger drive share price growth for Disney?

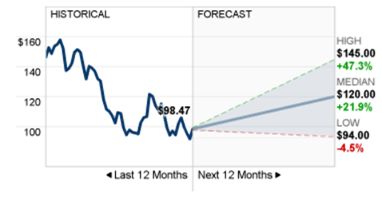

It remains to be seen if Iger’s return to Disney will prove an inspired or desperate move but market analysts seem confident he can drive the company’s share price back up. Only the most negative analysts believe Disney’s valuation will drop over the next 12 months, and then to just $94, which is only slightly below the current $96.21 level.

Downside from the current valuation looks limited and on the upside, the median 12-month share price target of 25 analysts polled by CNN is $120, which would represent returns of almost 25%. The most optimistic analysts have a 12-month share price target of $145, which would deliver returns of over 50%.

Iger has a challenge on his hands and just 2 years to rise to it. But if early signs are positive, Disney investors are likely to be hailing the Boomerang Boss this time next year.