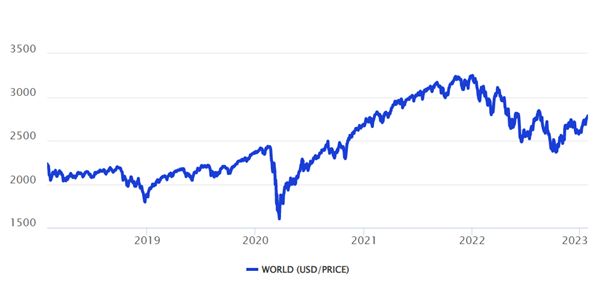

Since its most recent low set in October, the MSCI World index has gained 20%, including around 6% since the beginning of the year. The index, which covers a broad selection of mid and large cap stocks covering approximately 85% of the free float-adjusted market capitalization in each country, is designed as a proxy to global stock markets, excluding emerging markets.

MSCI World index

Source: MSCI

In the UK, the FTSE 100 benchmark index is up 2.79% for the year-to-date and up 13.76% since its own January low. Over on Wall Street the broad based S&P 500 is up 6.44% this year and 13.5% since its most recent low on September 30.

It has been an even better beginning of the year for the tech-focused Nasdaq whose heavy growth stocks weighting was hit particularly hard by last year’s bear markets and didn’t record its recent low until December 28. The index is up almost 12% for the year and 13.8% since that late December bottom.

With inflation figures around the world showing signs that price rises are finally slowing down, helped along by lower oil and gas prices, talk has turned to central banks led by the Federal Reserve taking their feet of rate rises. This week saw media speculation that the Fed could halt the rate rises that have taken the base interest rate in the USA from around zero at the beginning of last year to 4.25%-4.5%.

Market sentiment has improved to the point futures markets now show traders see a near-20% chance of rate cuts by the end of the year.

Investors should show caution before flinging themselves back into the market

There were a handful of moments throughout 2022 when the narrative that inflation is cooling and interest rate rises would be pulled back on started to gather pace. On each occasion, it proved overly optimistic.

This time markets have gathered much more of a head of steam than at any other point since the beginning of the current bear market in late 2021. That’s given rise to optimism the worst may already be behind equity investors. However, experienced heads are urging caution.

While there is always a chance of a milder global recession than feared, especially if rate rises are paused or even reversed, there are also still dark clouds on the economic horizon. Market sentiment is still frail and there is a feeling it wouldn’t take much to shatter investor confidence, sending benchmark indices into reverse again.

Is bull market optimism a mirage caused by long years of now unrealistic returns?

Many of today’s money managers, traders and retail investors have spent a huge chunk, if not the majority or entirety of their investment careers in the environment of the longest bull market in history. A period of steady gains, which fuelled by hugely loose monetary policy accelerated on a number of occasions, stretched from 2009 until late 2021.

It was only briefly interrupted twice, by a correction in late 2018 and again in early 2020 when the Covid-19 pandemic hit. On both occasions, the reversals were sharp but very short lived and powerful upwards momentum soon resumed.

The surge in valuations after the Covid crash that lasted until the start of this bear market was particularly intense. In 2020, the Nasdaq plunged almost 30% between mid-February and March 20 but November 19 2021 had gained over 130%.

The surge was fuelled by money pumped into the system by major central banks around the world to keep economies afloat during the lockdown periods that punctuated the pandemic over 2020 and 2021. Growth companies, mainly from the tech sector, yet to make a profit and some barely even making any revenues went public at valuations in the billions.

The same flood of cash catalysed a wave of inflation not seen in 40 years. It was first presumed, and forecast by central banks like the Fed and Bank of England, that this surge in inflation would be short-lived and fade as the global economy and supply chains worked out the kinks they pandemic had caused. Then Russia invaded Ukraine, sending oil and gas prices soaring, pushing inflation rates up further and locking them in for an extended period.

The equity markets meltup that held until late 2021 had shades of the 2000 dotcom bubble, with company valuations completely divorced from fundamentals such as revenues and profits. The consequences were also similar and unprofitable companies saw their valuations wiped out.

Even highly profitable companies like the Big Tech cohort of Apple, Amazon, Alphabet, Meta and Microsoft saw valuations pumped up by previously surging markets devastated. The tech giants saw over a trillion dollars wiped from their combined market capitalisation in just three days last May.

But despite the recent carnage and bleak macro-economic, many investors seem convinced a return to a bull market would again be relatively quick. With the most overvalued new market entrants knocked back down to size, or wiped out, optimism has abounded the froth has been taken out of markets and profitable companies oversold.

But some of the world’s biggest investors think optimism has returned far too quickly because investors have become too accustomed to quick recoveries from stock market downturns.

Why the recent stock market recovery could be wishful thinking

Quoted by the Financial Times, Nicolai Tangen, head of Norway’s $1.3 trillion state oil fund believes there is a high chance the Fed has not finished with its rate rises yet. He thinks that it and other major central banks such as the ECB and Bank of England will accept the consequences of a recession, even a harsh one, before risking allowing inflation to take a grip again.

He suspects we may well be in the process of transitioning from one long economic cycle of high returns in place for 40 years and into a new one of much lower returns investors will have to get used to. A period of years of inflation volatility could, he warns, lie ahead and interest rates will be used to keep it under control.

Late last year, central banks being willing to squash a market recovery with more aggressive rate rises was seen as unlikely and a relatively low risk. The big hitters are now taking that prospect much more seriously. That’s something for retail investors to consider before returning to the market with too much enthusiasm after a strong start to the year. By spring that optimism could be melting away with the last of the snow.