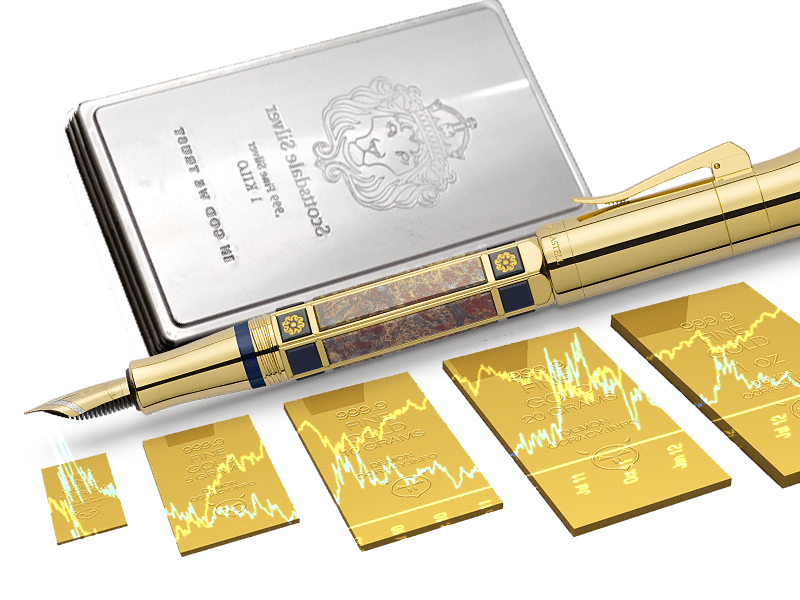

For centuries, gold has been regarded as a timeless safe-haven asset. It is such an ultimate preserver of wealth, for it has outperformed most other forms of investment like bonds and shares. For the reason that it is uncorrelated to other assets, gold is considered as a defensive asset in times of economic volatility that provides a well balanced portfolio.

Wanna start investing in gold? Some basic guides below may help you.

1. Types of gold investment

In investing, everyone undoubtedly expects gold has an intrinsic and potentially rising investment value. For most people, the very first consideration for starting gold investment is perhaps the types of gold investment itself. Basically, there are five types of gold investment: physical gold (e.g. gold bars and coins), gold exchange-traded funds (ETFs), gold mutual funds, gold mining stocks, and gold options and futures.

2. Where to buy gold

Gold is now available both on the local conventional gold/bullion dealer and on the internet. Some good conventional gold/bullion dealers in the UK are BullionByPost in Birmingham, ATS Bullion Ltd in London, and Chards in Blackpool. Somehow, if you consider the safety factors of buying gold physically on your own or if you like hassle free, it is advisable to buy it online.

There are so many online gold dealers in the UK such as Baird & Co (www.goldline.co.uk), Bullion Vault (www.bullionvault.com) and BullionByPost (www.bullionbypost.co.uk). You can trade gold even while enjoying your tea time through your gadget, and the website company will ship it to you. Still, before you decide through which you will buy your gold, it is wise to do research first.

3. Where to store gold

In case you prefer to invest in physical gold, one of the benefits is that you can control your physical possession. In parallel with it, you should consider where to store your bullion. Though you can keep thousands of pounds worth at home, I personally think that it is not a good idea since it may not be covered by your home insurance. It is imperative to consider secure professional storage such as allocated storage and a bank safety deposit box. Of course, they will cost you for such insurance premium.

4. When to buy gold

Many investors simply buy smaller quantities of gold coins and bars when they can. Compared to buying gold in single large transactions, it provides investors the benefit of buying at a lower average price with the same applying to part selling in order to maximum return on investment. Yet, when looking to buy gold, it is imperative to keep an eye out for any major news and announcements coming from institutions including Banks, the Stock Exchange, Wall Street, Governments etc. Generally, the price of gold and silver rises when other investments such as property and stocks are underperforming. This often provides an ideal time to add more gold bullion to your portfolio or start your investment in gold.

5. How long to hold my gold

Gold is a long-term investment. Ideally, gold price has been increasing almost month on month. Though there may be dips on a certain month, the price usually rises larger than the dips on the following months. Thus, it is advisable to hold it for a minimum of six months or much longer. It is your prerogative, somehow, to consider how long you hold your gold.

All in all, it is important to research everything before buying gold for your investment.