Enterprise Investment Scheme – What is EIS? – Tax Relief for Investors – IHT Exempt & CGT Deferred

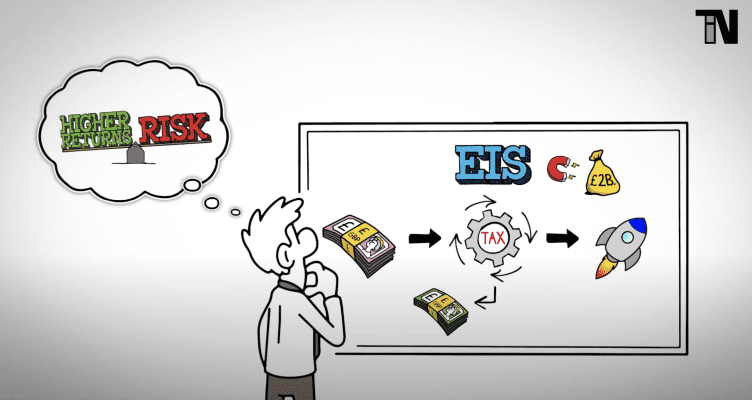

The government’s Enterprise Investment Scheme, often simply referred to as EIS, is tax-efficient way to invest in start-ups and now attracts over £2 billion in investment every year.

For investors that have used up their ISA & SIPP allowances, but not only, it can be tricky to find interesting investment opportunities that balance a little more risk with the potential for higher returns without adding to often already hefty tax bills.

In this short video, you’ll learn all of the basics on EIS investments – the tax advantages they offer high net worth investors and how investing through the scheme helps reduce the risk of investing in the UK’s most promising start-ups and growth companies.

Sources: www.ft.com, www.gov.uk