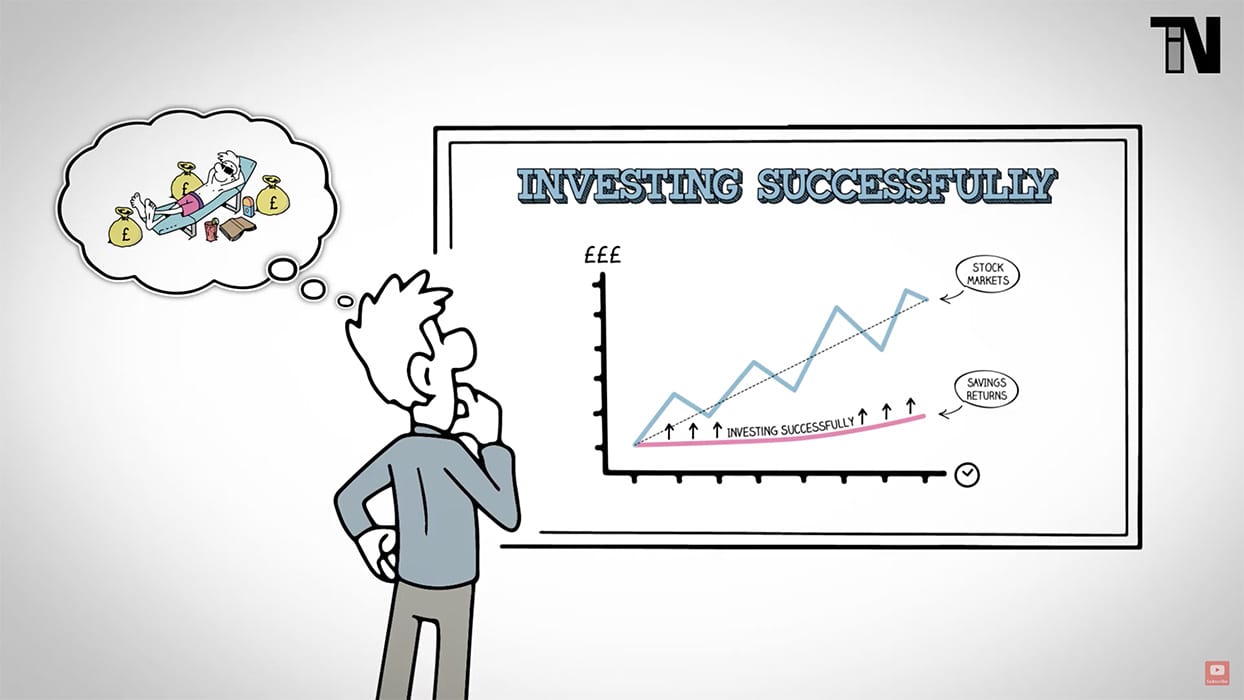

Investing successfully, defined as creating wealth over the long term through returns superior to no to low-risk savings products, is something that has, historically, been possible for even small, private investors.

Despite their short-term ups and downs, major stock markets like London, Wall Street and European centres like Frankfurt have always increased in value over the long term.

A quick look at Yahoo or Google Finance data shows the average 20-year return from the Dow Jones industrial average is around 7%, rising to almost 11% over 30 years.

By way of contrast, putting money in a savings account, or investment grade government bonds, barely keeps the investor ahead of inflation. Currently, the best long term easy access savings account rate on offer in the UK is around 1.16%.

So, while investing might sound or seem complicated to new investors, the good news is that it doesn’t need to be. For investors with a long-term outlook, solid returns are more than achievable.

However investors do have to make sure they avoid making some common mistakes, which can undermine what should be a relatively uncomplicated, long-term investment strategy.

By simply not making these 8 common investing mistakes, you’ll be well on your way to realising worthwhile long-term returns on your investment portfolio.